Learn to Buy Apartment Complexes WITHOUT Using Your Own Money

Step-by-step course that shows you how to find deals, attract investors, and close profitable multifamily properties - even if you've never done a deal before.

Enroll Now for $397

Trusted by New & Experienced Operators Alike

We have helped students close 8-unit, 40-unit, and even 100+ unit deals using the strategies inside this program!

Everything You Need to Go From Zero to Closing Deals

🔍 Find & Analyze Profitable Deals

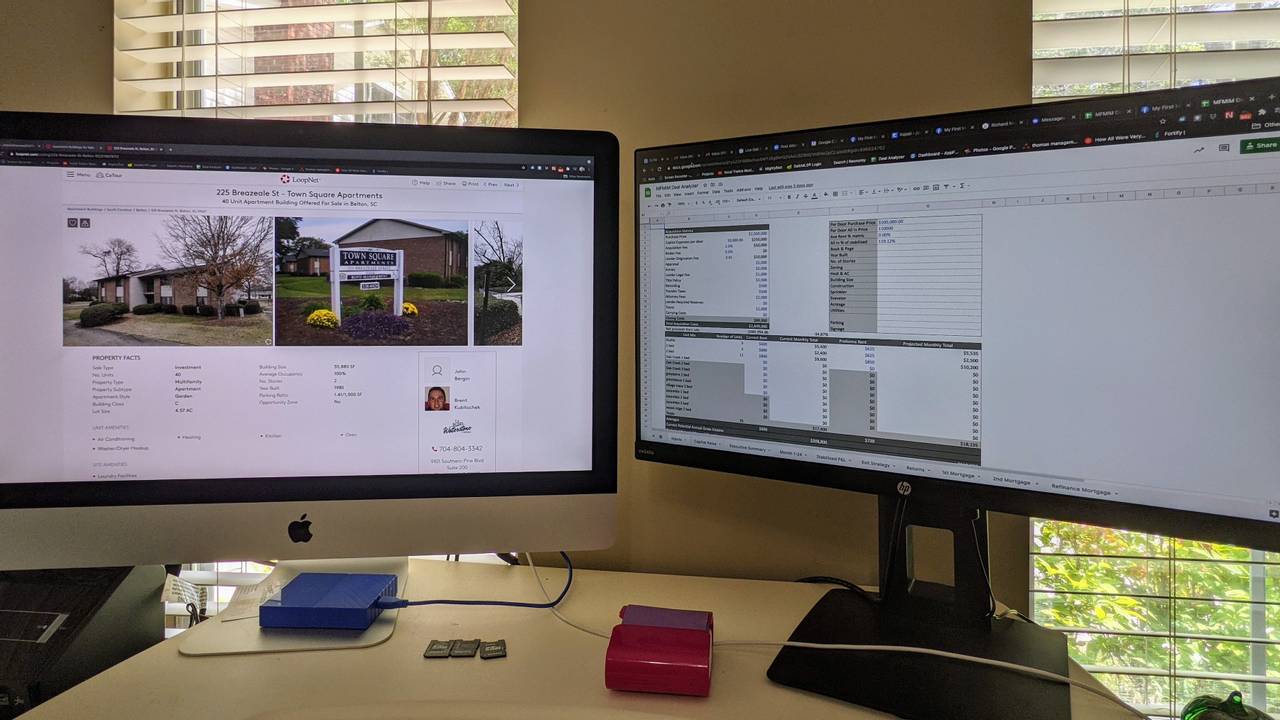

📊 Underwrite Like a Pro (Templates Included)

💵 Raise Capital with Confidence

🚀 Scale Your Portfolio

Jacqueline - 40 Units

- Build real wealth through multifamily ownership

- Create passive income with real estate backed assets

Tim - 88 Units

- Legacy wealth that endures

- Retirement solved with ONE deal

Everything You Need to Get Started and Close Your First Deal

MFMIM - The Full Course

-

Intro

2 lessons- 1.1 why are we here?

- 1.2 welcome Pinopolis Case Study

-

How do I get the down payment

10 lessons- 2.1 Use your own or raise money?

- 2.2 How do I find investors?

- 2.3 The main thing investors really want and how you can deliver it

- 2.4 The investor's you SHOULDN'T take money from

- 2.5 The allure of private equity

- 2.6 getting your mindset right for raising money

- 2.7 the script to unlock millions

- 2.8 chicken or egg

- 2.9 1st investor meeting

- 2.9.1 1st investor meeting - Terms

-

Raising money LEGALLY

15 lessons- 3.1 how do I form an LLC

- 3.1.1 forming the LLC

- 3.2 the SEC

- 3.3 What is a JV

- 3.4 What is a syndication

- 3.5 506(b) syndication

- 3.6 506(c) syn

- 3.7 Op agreements for LLC

- 3.7.1 scenarios for Op agreement

- 3.7.2 protection from other partners

- 3.8 PPM

- 3.9 Subscription agreement

- 3.10 Do I need an attorney

- 3.11 How do I raise $ from IRA's

- 3.11.1 ira drawback

-

Where to buy?

4 lessons- 4.1 Finding Deals outside your area

- 4.2 Phase 1 lexington

- 4.3 Phase 2 Tulsa

- 4.4 Phase 3 Moline

-

Where is my deal? How do I find it?

9 lessons- 5.1 The best way to get into the game-find a deal

- 5.2 Speak the language-how to be taken seriously

- 5.3 networking groups

- 5.4 brokers

- 5.5 Social media

- 5.6 On the market

- 5.7 brokers pt 2

- 5.7.1 communicate with brokers

- 5.8 Property Managers

-

This is a Team Sport-Who's on your team?

4 lessons- 6.1 Gaining credibility through partnerships

- 6.2 How to find them

- 6.3 Who do you need?

- 6.4 Its not about this 1 deal-giving away equity

-

Get your offers ACCEPTED

11 lessons- 7.1 Facing your fear

- 7.1.2 facing your fear

- 7.2 Its all about the numbers

- 7.3 steps to contract overview

- 7.3.1 Talking to a broker/seller confidently and competently

- 7.3.2 The first step to contract-The LOI

- 7.3.3 how to make your offer more attractive

- 7.3.4 The Purchase and Sale Agreement-Protect yourself and control the deal

- 7.3.5 financing contingency

- 7.3.6 The milestones in a contract

- 7.3.7 Contract amendments

-

Don't lose money-Due Diligence Done Right

5 lessons- 9.1 Don't get overcommitted. Dating, engagement, marriage

- 9.2 What do I do? When do I do it?

- 9.3 stories - financials

- 9.4 physical

- 9.5 Understanding the downside of failed DD

-

Getting the loan

8 lessons- 10.1 what is a commercial loan

- 10.2 what are the types of commercial loans

- 10.3 second option - bridge loan

- 10.4 how do i get a loan

- 10.5 what if i can't get a loan

- 10.6 a bad loan is better than none at all

- 10.7 owner financing

- 10.8 more detail on seller financed down payment

-

Crossing the finish line like a pro

3 lessons- 11.1 Make sure you have enough money

- 11.2 Paperwork Prep for Closing

- 11.3 The last 7-10 Days

-

Operating your new property

10 lessons- 12.1 Who not how....Managing it

- 12.2 Three Options for Management

- 12.2.1 in house management

- 12.2.2 residential manangment company

- 12.2.3 commercial management company

- 12.3 Key to success-the right manager

- 12.4 Asset Management

- 12.5 Keeping up with your repairs and maint

- 12.6 How to increase income

- NOI-Massive value

-

How to pay zero taxes

4 lessons- The cost segregation study

- investor loves cost seg

- The 1031

- Finding the right accountant

-

Multiple Exit Strategies

4 lessons- 14.1 Case study - Refi

- 14.2 Case Study Refi Numbers

- 14.3 Case Study Flip Numbers

- 14.4 Refi Exit

-

Making your dream-REAL

5 lessons- You are your habits-Carving out your new life 30 mins at a time

- How to GUARANTEE you will not fail

- Double your chances-get a partner

- The hit list-Pick 3 a day

- Staying motivated-Is your "why" big enough?

-

Document Library

22 lessons- Investor Database Spreasheet

- Seller Due Diligence Doc Request

- The Script to Unlock Millions

- Sample Executive Summary

- Sample Deal Package

- Sample LLC Operating Agreement

- Sample Private Placement Memorandum (PPM)

- Letter Of Intent (LOI) Template

- Purchase & Sale Agreement (PSA) template

- Due Diligence Timeline Checklist

- Due Diligence Sheet from Monday.com

- Seller Finance LOI

- Example Promissory Note

- Source & Use Example

- Hit List - Action Items

- Deal Analyzer Google Sheet

- 5 Minute Deal Analyzer

- Real Estate Terms

- MFMIM Comprehensive Deal Analyzer

- Seller Carry Disbursement Letter

- Guaranty (Continuing Debt - Unlimited)

- Disbursement Agreement

Yeadon jumped into multifamily investing after he went through his first online course in how to get into the game.

In 2019 he found his first apartment deal. Eighteen units in a small town, and syndicated it with his partner, Jennings.

After the first deal, there was no going back. The possibilities exploded. He focused on operations and efficiency and grew assets under management from $1mil to $30mil over the next 18 months.

Yeadon’s passion is building cash flow in abundance to be able to have freedom and build a legacy for the future.

Jennings realized the power of cash flowing real estate early on, and decided to education himself on how to grow that business, not with single family homes, but by going after multifamily properties. He studied for years to learn the industry, taking multiple courses of several years.

He landed his first apartment deal in 2019 with a JV partnership. From there it grew until he now has a portfolio of 700+ unit so far! His passion is creating time freedom in his life so that he can focus on leaving a legacy for future generations.

Jennings wants others to experience the freedom that comes with investing in real estate.